World's First Client-Centric Digital Investment Bank

Delivering institutional-grade financial assets with compliant, on-chain solutions tailored for sophisticated investors.

Our Mission

At Laplace, we empower institutions and investors with compliant, institutional-grade financial access through a trusted infrastructure, delivering unparalleled tailored opportunities that transcends the limitations of traditional finance.

Laplace offers market-adaptive products that provide investors with tailored opportunities for growth and diversification across multiple sectors.

560M crypto adoption owners worldwide and growing

$16.1T assets projected to be tokenized by 2030

Immediate access to regulated research, transparent financial products, and flexible collateral management solutions. Secure your investments with 100% control over your assets now.

Euro Yield

- LEURY

Expected Return

- Equal to or greater than the benchmark rate.

Min. Investment

- $10,000 EURO

US Dollar Yield

- LUSDY

Expected Return

- Equal to or greater than the benchmark rate.

Min. Investment

- $10,000 USD

Crypto Funding Arbitrage

- LCFARB

Expected Return:

- 12-15%

Min. Investment

- $10,000 USD

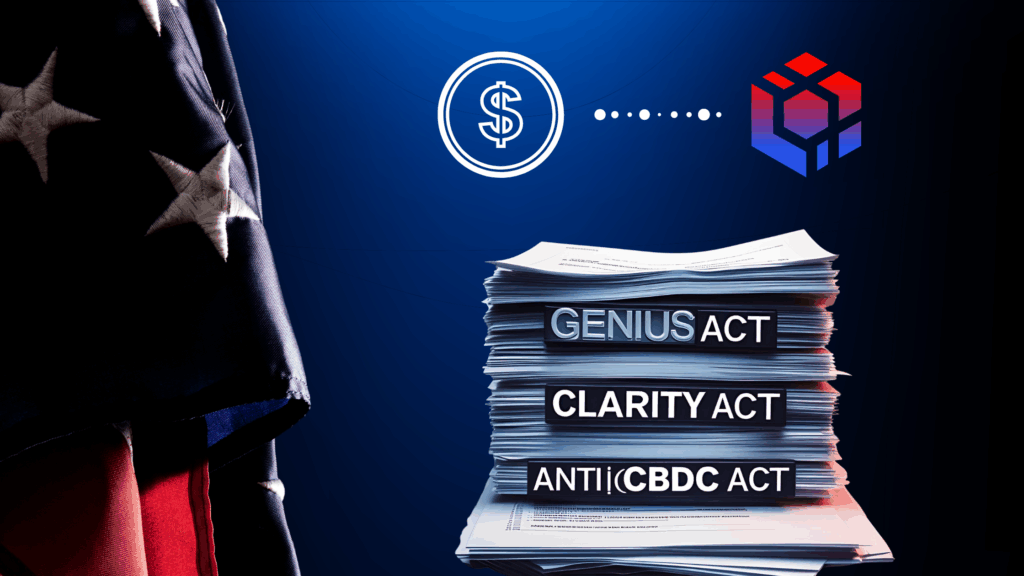

U.S. Digital Finance Realigned: How the GENIUS Act, Clarity Act, and Anti‑CBDC Act Accelerate Institutional Adoption – and Why Laplace Is Positioned to Lead

Discover how the GENIUS Act, Clarity Act, and Anti-CBDC Act reshape U.S. digital finance, accelerating institutional adoption of tokenized markets. Learn why Laplace, a Singapore-based, compliance-first platform, is positioned to lead with its innovative infrastructure for global investors.

Learn more about the revolutionary tokenization process and how we use it to benefit you.

- Increased Liquidity

- Global Accessibility

- Fractional Ownership

- Regulatory Compliance

- 24/7 Market Access

- Frictionless Transactions

- New Investment Opportunities

- Diversification Opportunities

- Inclusive & Efficient Protocol

- Transparency & Security