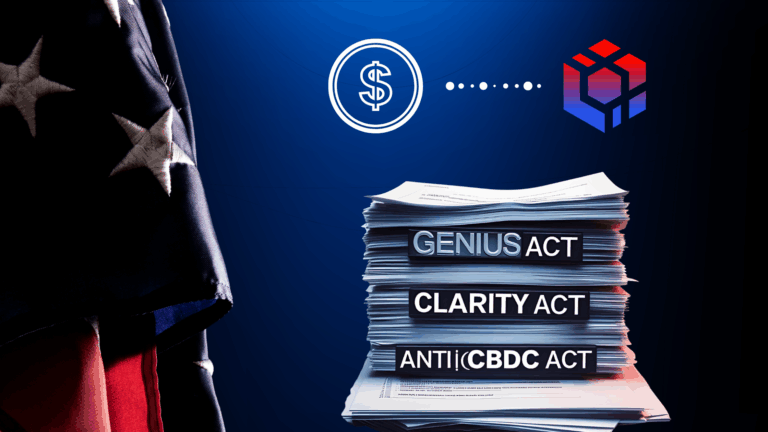

Discover how the GENIUS Act, Clarity Act, and Anti-CBDC Act reshape U.S. digital finance, accelerating institutional adoption of tokenized markets. Learn why Laplace, a Singapore-based, compliance-first platform, is positioned to lead with its innovative infrastructure for global investors.

Explore our insights on navigating the new era of finance with hedge-adaptive investment products, leveraging tokenization and blockchain technology to redefine investment strategies for the next digital age.

Examine the key shifts in capital allocation during the first half of 2024, driven by the DTCC's updated stance on Bitcoin ETFs and enhanced regulatory frameworks in digital assets by highlighting the DTCC's exclusion of Bitcoin ETFs from collateral requirements. Additionally, we cover Laplace's compliant strategies for optimizing returns and managing risks through advanced hedging and strategic borrowing, aligning with the latest regulatory trends.