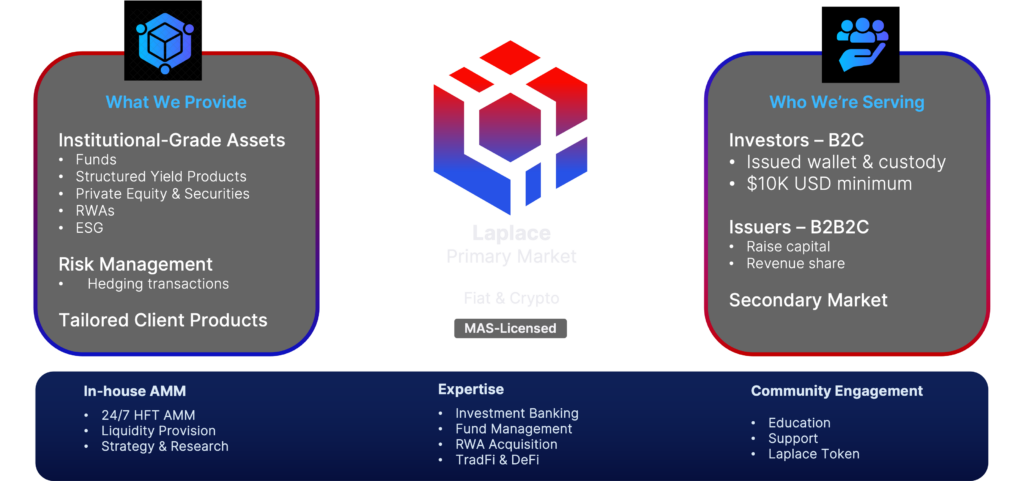

Hybrid Expertise

Laplace’s distinctive strength lies in the fusion of time-honored traditional finance expertise with innovative DeFi strategies, offering our clients not only a marketplace but a strategic partner to grow with in the future of finance.

Traditional Finance (TradFi): Our Legacy in Investment Banking

Our investment banking approach defines our excellence in managing wealth with a high emphasis on risk management.

Regulatory Trust: We operate under the Monetary Authority of Singapore (MAS) and Capital Market Services (CMS)-license of Namara Wealth Advisors (NWA) to ensure regulatory compliance. Working under the same leadership at Laplace allows us to integrate applied knowledge in sales and trading, financial advisory, fund and wealth management, real world asset acquisition, and customized investment strategies with decades of successful client management experience into the landscape of a liquid asset marketplace.

Global Reach: We have common financial values that resonate with our affiliates and brokers globally, such as Interactive Brokers and Saxo Bank.

Custodial Security: Partnering with trusted banking custodians such as DBS and SCB, we prioritize the security and integrity of our clients’ assets under centralized governance by institutions positively recognized for their custodianship, ensuring that all assets are safe.

Investment Banking Giants: Our investment banking leadership hones strong professional relationships and ongoing collaborations with premier institutions such as Goldman Sachs, Barclays, and Societe Generale Group to gather market insights and identify strategic avenues of finance. Our expertise and network form the foundation that empowers us to navigate financial complexities with precision.

Decentralized Finance (DeFi): Market Making Prestige

Our crypto trading specialist, Laplace Research Capital – an in-house Automated Market Maker (AMM) platform – also operates under the compliant oversight of Namara Wealth Advisors, pioneering the DeFi front with proven expertise in trading, market analysis, and research. This combines our experience in using cutting-edge blockchain technologies with the “Laplace” team’s trading acumen to process extensive sets of economic and financial data to maximize asset selection for our clients.

Navigating the intricate landscape of digital assets, Laplace Research Capital excels in applying traditional investment banking strategies to crypto trading. Our wealth of knowledge and successful trading practices position us at the forefront of the DeFi evolution, offering an edge of actionable liquidity and strategic precision in a new, exciting, and rapidly evolving markets.

Laplace Research Capital’s talent originated from Singapore and actively trades in Hong Kong and Japan on leading global digital asset exchanges such as Gemini, Binance, Coinbase, OKX, Bitflyer, and rising CEXs and DEXs in the world.

We Connect Our Clients to Tangible Solutions

“You can’t connect the dots looking forward. You can only connect them looking backward.” – Steve Jobs

Our team’s imprint in traditional finance is a testament to surpassing fiduciary duty and elevating client experiences in diverse financial sectors. Having navigated multiple economical cycles and witnessing evolving efforts for improvement among governments, institutions, and the investor market, our team is passionately committed to deliver on three key focuses that we believe will guide the future of finance towards a more sustainable growth:

Adaptability: Our entire ecosystem and investor products evolve with changing market conditions to ensure resilience and responsiveness to the dynamic financial landscape for our clients.

Accountability: We effectively combine accountability and efficiency in organizational performance and client-centered compliance to foster trust and reliability.

Accessibility: Give tangible results to our investors by bringing them access to elite opportunities through a state-of-the-art platform.

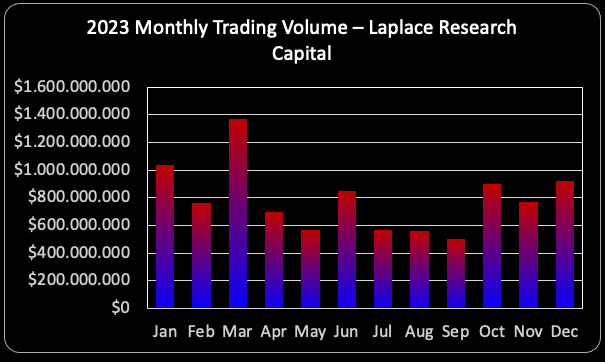

Laplace Research Capital is a proven resilient automated market maker (AMM) that executes on High Frequency trades (HFT) 24/7, with over $90 Billion USD traded since 2020. The large volume of trades directly impacts global liquidity, stabilizes asset values, and the obtainment of favorable trading fees on exchanges.

This brings significant competitive value for our clients, as AMMs can adapt to changing market conditions, including volatile trading pairs and assets in the DeFi landscape. This allows Laplace to offer a diverse range of assets, safely bridge traditional investors into the crypto space, and provide more immediate, seasonally adaptive investments to the marketplace, even when market conditions change.

As a new era industry leader, Laplace integrates traditional investment banking acumen into the crypto market space, bridging the established financial domain with the decentralized future of finance, built for investors.