The evolution of blockchain-backed financial investments often highlights three core pillars: trust, practicality, and integration. Whether the narrative serves accredited or retail investors, the latest blockchain-integrated solutions have ushered in a new wave of possibilities stemmed from an anticipated foundational role that blockchain will play in reshaping financial markets.

As institutions actively reimagine and rebuild their infrastructures to meet investor demand for adaptability, diversification, and efficiency, this shift has created a spillover effect in driving greater demand for multi-asset strategies. This is essentially combining equities, fixed income, commodities, and alternative investments to deliver more robust portfolios that reshapes how institutions and investors approach diversification across multiple asset classes.

However, as we move past traditional financial systems’ inefficiencies, both traditional and decentralized institutions often operate in silos and remain constrained by bureaucratic processes and legacy systems, which limits the full potential of multi-asset strategies. While tokenization is meant to break down largely cost and process-driven barriers in finance, it uniquely positions regulated family offices like Namara Wealth Advisors (NWA) whose tokenized investments marketplace, Laplace, is newly created to respond to market demands with flexibility in delivering alternative, bespoke structured products that major institutions simply cannot match in precision or efficiency when curating multi-asset opportunities.

Why Multi-Asset Strategies Matter: How Laplace Tackles the Demand

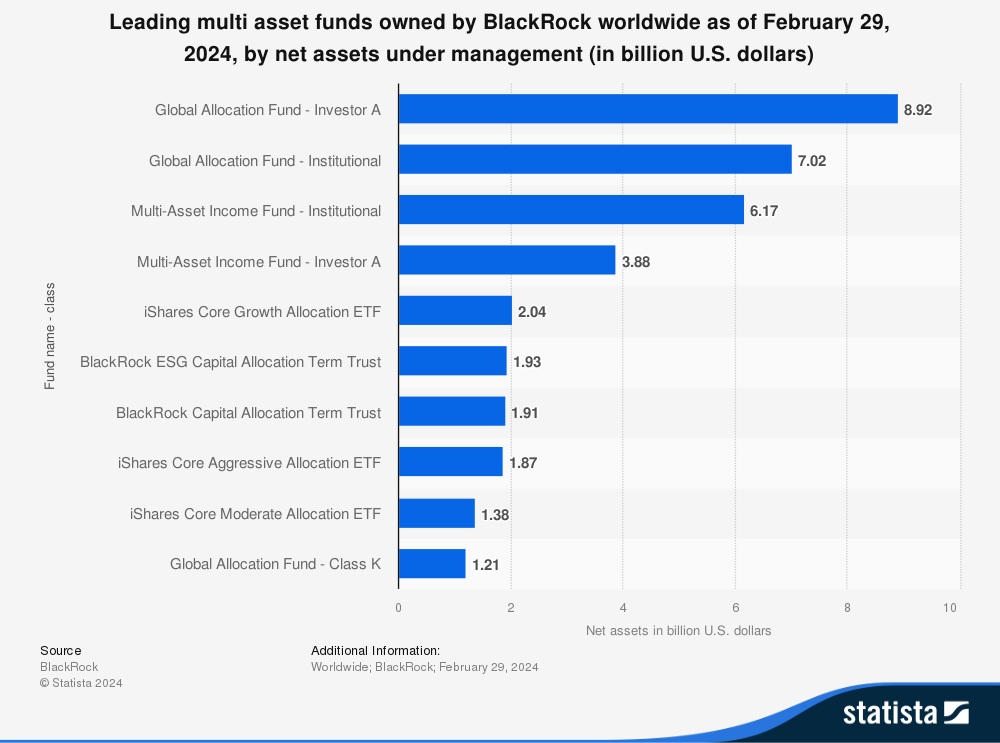

As seen in the chart above, BlackRock’s leading multi-asset funds are collectively managing billions of assets, with growing demand for more diverse portfolios and strategies over time. This is an indicator that investors consistently seek diversified investment approaches to manage risk in order to achieve consistent returns. The allocation of capital across asset classes like equities, fixed income, and a growing number of alternatives assets, including cryptocurrencies such as the Bitcoin ETF, are highly sought after for their balanced exposure via multi-asset funds.

Despite their potential, both traditional and decentralized systems face limitations. Traditional institutions are hindered by high costs, long settlement times, and fragmented processes. Decentralized platforms, while making finance more accessible, often lack the structured, risk-managed frameworks necessary for institutional-grade investments.

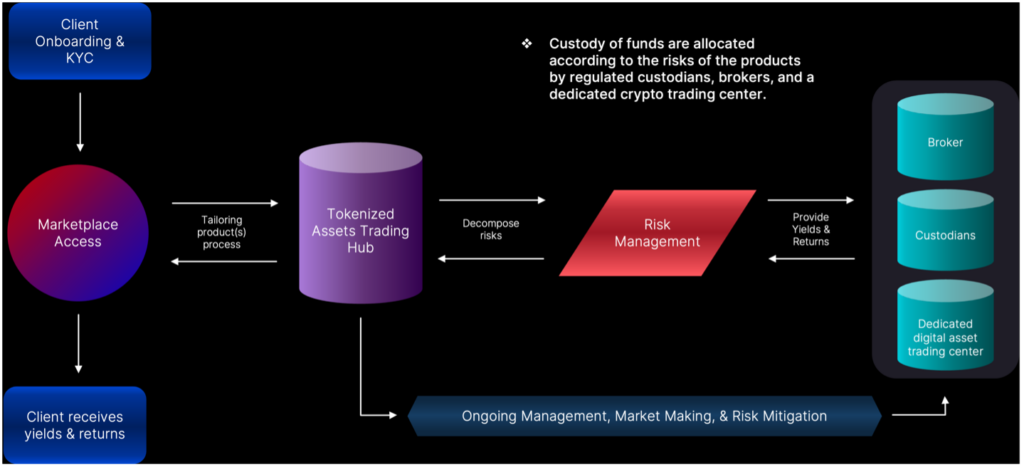

Laplace bridges these divides by combining the rigor of traditional finance with the agility and transparency of blockchain-enabled decentralized systems. We structure and issue tokenized products that integrate seamlessly across both ecosystems to provide investors with diversified opportunities enhanced by liquidity through our high-frequency trading (HFT) system. This unique alignment of risk management, trading expertise, and years of personalized client portfolio management positions us to deliver tailored solutions that neither traditional nor decentralized platforms can fully achieve on their own.

The Role of Tokenization in Transforming Investments

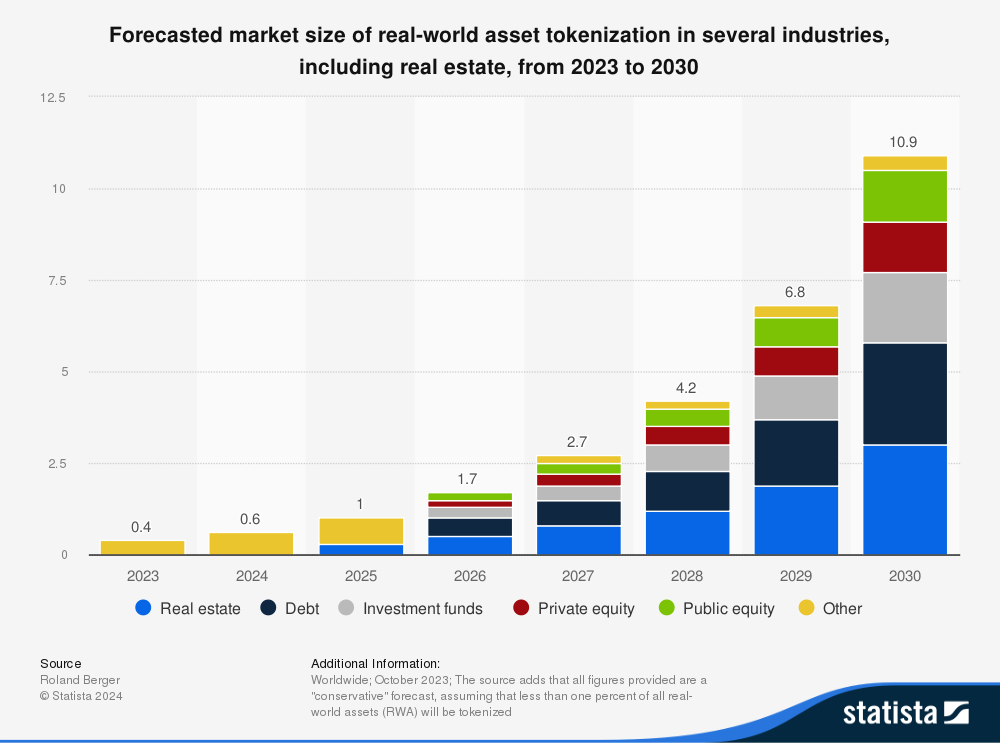

By enabling actual digital representations of real-world assets, tokenization eliminates inefficiencies in traditional markets that significantly lowers barriers to institutional-grade investments. We are seeing investment requirements from averages of $250,000 USD to as low as $5,000 USD to access both traditional to multi-asset opportunities. Blockchain’s ability to enhance settlement and transparency provides greater visibility into opportunities by empowering investors to flexibly manage their capital and potentially optimize returns through fractional ownership. Tokenization naturally compels institutions to adapt and meet the growing demand for such solutions.

Laplace Sets the Standard

Laplace goes beyond tokenization’s foundational benefits by embedding sophisticated risk management and capital efficiency into its product offerings. For example, our fixed-income products are not only tokenized but also structured to optimize liquidity and mitigate counterparty risks. By working with credible global platforms in both traditional and decentralized ecosystems, we deliver products that combine the stability of traditional finance with the flexibility of decentralize solutions.

Unique Expertise Rooted in Regulation

Laplace was founded under the regulatory umbrella of Namara Wealth Advisors (NWA), whose operators bring decades of executive experience in investment banking and licensed fund management. While the first step in integrating blockchain into finance is to tokenize and list versions of existing funds, Laplace goes further by issuing bespoke financial products tailored to the specific needs of institutions and investors. Our multi-asset marketplace bridges the strengths of both traditional and decentralized systems to offer unparalleled opportunities in the market.

Our Proven Infrastructure Sets Us Apart

Our proprietary high-frequency trading (HFT) capabilities with deep expertise in risk management enhances capital efficiency for businesses while optimizing returns for investors. By issuing tokenized products including fixed income and private equity deals, we are pioneering a new class of alternative assets with secure, scalable investments.

Laplace ensures compliance with stringent regulatory standards by operating under NWA’s licensed fund management framework. Our foundation and comprehensive approach to institutional-grade products sets us apart as a reliable gateway in leveraging tokenization for a new chapter of opportunities.

Laplace’s Advanced Approach to Assets Issuance

Fixed Income on the Blockchain

One of Laplace’s notable products is our issuance of tokenized fixed-income assets. What sets us apart is our ability to integrate unique structural innovations that preserve the stability of fixed-income products while enhancing yield potential and market accessibility through fractionalizing units and the use of our HFT system. These tailored strategies bring a new level of flexibility to fixed-income investing and offers institutions and investors dynamic alternatives to traditional markets.

Collateralized Private Debt

Laplace has also made strides in tokenizing private debt opportunities that were also exclusively designed for institutional investors. To expand access to broader investors, our products are structured to balance yield and risk management potential to optimize collateral and enhance capital efficiency. Unlike standard tokenized platforms, Laplace’s strategies provide liquidity and security while opening new innovative opportunities for investors to participate in that go far beyond simple tokenization.

Why Institutions Choose Laplace

Laplace is more than a marketplace – we are a bridge between traditional and decentralized finance, tackling the problem of major institutions inability to fully capitalize tokenized opportunities. Though our unique position in the field, we offer investment solutions that are truly transformative for institutions and investors by providing an infrastructure with investment expertise, regulatory compliance, and tokenization.

Track Record

Laplace’s innovative approach is supported by tangible results through its operations at NWA, managing significant AUM in private credit, private equity, and alternative assets (including digital assets), and facilitated over $100 billion in cryptocurrency trades. These results demonstrate our ability lead the future of finance with more sophisticated, secure, and scalable solutions for institutions and investors alike.

Leadership in Multi-Asset Opportunities

There is no doubt that tokenization will play a pivotal role in delivering multi-asset opportunities. As the demand for diversified investment solutions and alternative assets continues to grow, Laplace’s expertise with advanced capabilities is the middle-ground that will reshape how investors access and benefit from diversified portfolios. Our tailored solutions set a benchmark value that traditional and decentralized platforms strives to achieve.

Key Takeaways

- Transforming Multi-Asset Strategies with Tokenization: How Laplace Is Changing the Game

- Why Multi-Asset Strategies Matter: How Laplace Tackles the Demand

- The Role of Tokenization in Transforming Investments

- Laplace Sets the Standard

- Laplace’s Advanced Approach to Assets Issuance

- Why Institutions Choose Laplace