Capital allocation continues to be the cornerstone in strategic financial management that plays a crucial role in assessing and managing risk. In the first two quarters of 2024, we’ve witnessed a new shift in capital allocation through the Depository Trust & Clearing Corporation’s (DTCC) evolving stance on Bitcoin ETFs. Let’s dive into how it’s impacting the future of financial markets, and why our approach to capital allocation supports the overall health of the financial industry.

Shifts in Capital Allocation

In 2020, some of the top digital asset industry buzzwords were “decentralization, NFTs, & Web3.” In 2024, the key buzzwords include “tokenization, liquidity, & real-world assets (RWAs).” As regulators grow their understanding of blockchain applications, the value of applying blockchain technologies to traditional assets like RWAs laid the foundational structure for tokenization.

In the first half of 2024 alone, we have seen the launch of Bitcoin ETFs and the acceleration of transformation in traditional financial systems. Traditionally cautious towards cryptocurrencies, the DTCC recalibrated their framework towards Bitcoin ETFs, signifying a pivotal change in the regulatory landscape.

Institutional Adoption and Bitcoin ETFs

The DTCC’s recognition of the growing demand and potential for investment diversification and digital assets’ ability to further liquidity was what prompted their support of Bitcoin ETFs. This powerful shift led to increased institutional participation in Bitcoin ETFs occurring from January to March 2024, which amassed over $12.5 billion in assets within a 3-month period. Although major institutions like BlackRock and Fidelity were the key players in this upsurge, the DTCC’s decision bolstered investor confidence in digital assets.

However, in April 2024, following the announcement from DTCC that Bitcoin ETFs would be excluded from its collateral requirements, Bitcoin ETF outflows of nearly $338 million occurred in only about two days. Despite the significant outflow in the short-term market adjustment, the inflows from January to March were still substantial, indicating that institutional interest in Bitcoin ETFs remains strong.

By excluding Bitcoin ETFs from DTCC’s collateral requirements, this allowed Bitcoin ETFs to align more closely with traditional ETFs. This reduces capital risks for institutional investors while simultaneously facilitating broader market reach in digital assets. Custodia Bank’s CEO, Caitlin Long mentioned that “it doesn’t matter if Wall Street doesn’t get to leverage this, as the market dynamics are evolving beyond traditional constraints.” This reassures the consensus across the financial system that the decentralization and democratization of financial assets are progressing in a direction that allows for a more inclusive financial ecosystem that doesn’t solely benefit Wall Street firms.

The following month in May 2024, the DTCC announced a collaboration with Clearstream, Euroclear, and Boston Consulting Group that “unveiled a blueprint for establishing industry-wide digital asset ecosystem to drive acceptance of tokenized assets.” This development provides a standardized approach to the settlement and custody of digital assets and drives the adoption of digital assets. Nadine Chakar, Global Head of the DTCC Digital Assets, asserted that the “industry needs to pivot and demonstrate tangible results and value generation.” Overall, a positive framework for the financial markets is being curated to welcome regulatory assessments of financial infrastructures and institutions that seek to incorporate digital assets into their ecosystems.

DTCC’s Risk Calculator

Correlating with latest technologies such as blockchain and AI to enhance workplace efficiencies, the DTCC also launched a risk calculator in June 2024 that provides market participants the ability to evaluate potential margin and clearing obligations, such as risk exposure, for any simulated portfolio. The integration of this new tool not only aligns with industry trends towards more sophisticated automation practices but sets new standards that streamline regulation and improve problem-solving in traditional finance risk management practices.

Laplace’s Advanced and Compliant Capital Allocation Strategies

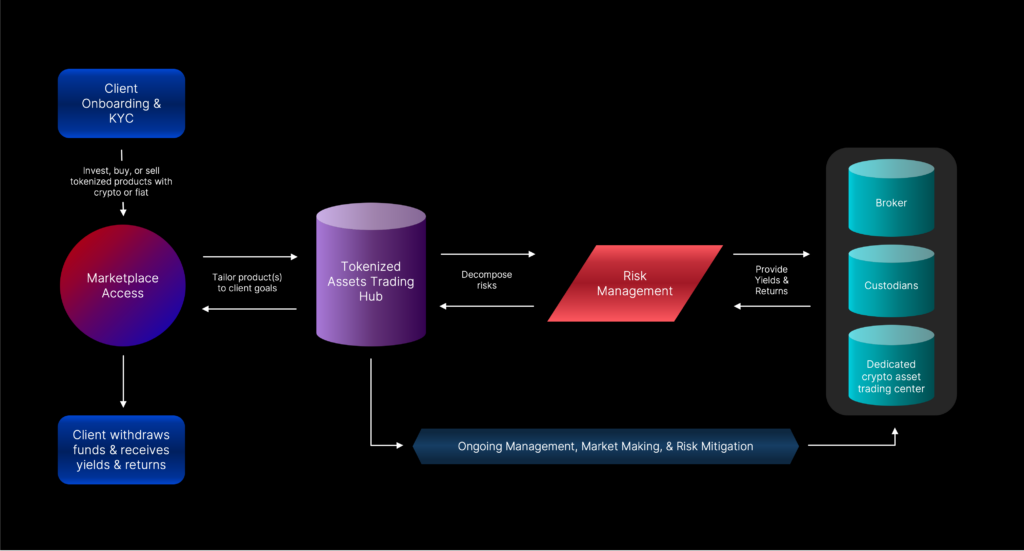

Following the DTCC’s latest developments to embrace digital assets into the financial system, our approach to risk management and capital allocation is strategically positioned to benefit both businesses and individual clients.

Customized Hedging and Risk Management

Laplace effectively manages risks by leveraging our proprietary high-frequency trading (HFT) strategies to decompose and mitigate risks, which allows us to strategically allocate collateral to protect our client’s investments from market volatility. Additionally, we collaborate with regulated custodians and brokers, and offer our clients the choice of using their private or issued ecosystem wallets to ensure a compliant and trustworthy environment that enhances asset management efficiency, which further democratizes investing in secure manner.

Strategic Borrowing for Enhanced Returns

In terms of making moves towards smarter financial practices in a technologically advanced future, Laplace offers strategic borrowing options that maximize returns on yield products while maintaining minimal risk in our ongoing risk management process. Our smart collateral management and secure partnerships maximize capital efficiency to provide higher returns for investors. By leveraging strategic borrowing, our clients can manage risks more effectively and position themselves for sustainable growth in their portfolios.

Laplace pairs investor expectations with decentralized applications to foster a healthy environment that aligns with the latest regulatory advancements and industry trends in finance. We are committed to using innovation for sophisticated capital allocation and risk management to deliver maximum returns for our clients in a compliant manner, and we look forward to more effective regulations that embrace digital asset utility.

Resource:

https://www.thestreet.com/crypto/markets/crypto-etfs-launch-in-asia-singapore-korea-hong-kong

https://cointelegraph.com/news/dtcc-rules-out-collateral-for-bitcoin-linked-etfs

https://www.nasdaq.com/articles/bitcoin-etfs%3A-after-record-%24328m-outflows-what-happens-next

https://www.marketsmedia.com/dtcc-launches-risk-calculator-ahead-of-treasury-clearing/